[BR] Customer Credit

Document status | COMPLETE |

|---|---|

Last Updated | |

Document owner | |

Designer | |

Developers |

|

QA |

|

Technology |

|

Related Documents | |

Design | |

Version | V5: |

Objective

When shippers apply for credit, the brokerage needs a way to view and manage it. Currently, there are two parts of this:

Manual: the brokerage has to manually run the credit check (current process) and input the value

Automated: view a list of customers that have applied for credit

The brokerage will also need a way to track how often the customer pays to build a credit score within Zuum.

Feature List/Requirements

Requirement | Acceptance Criteria | |

|---|---|---|

| 1 | Notification of new Shipper | Receive an email when a new shipper account has been created |

| 2 | Shipper info and credit check info saved under ‘Customers’ | When the shipper fills out their personal and company info, it will be saved in their profile, including the credit limit. When the credit limit is saved into the profile, the shipper can only book shipments under their limit References (if any) is also to be added |

| 3 | Update credit limit and auto-apply to the Shipper app | If a shipper were to call Zuum requesting a credit extension, Zuum can increase the credit limit for that shipper and once If the shipper requested an extension and approved by the broker, the shipper’s credit limit should be updated as well. |

| 4 | Days to pay / Credit score (internal) | Keep track of customers with their total credit limit, available, used, and days of paid. Way to track how well they pay and to determine if they qualify for credit or credit increase. |

| 5 | Credit Queue | Shippers waiting on manual credit checks, new shippers with recently performed checks, waiting, etc |

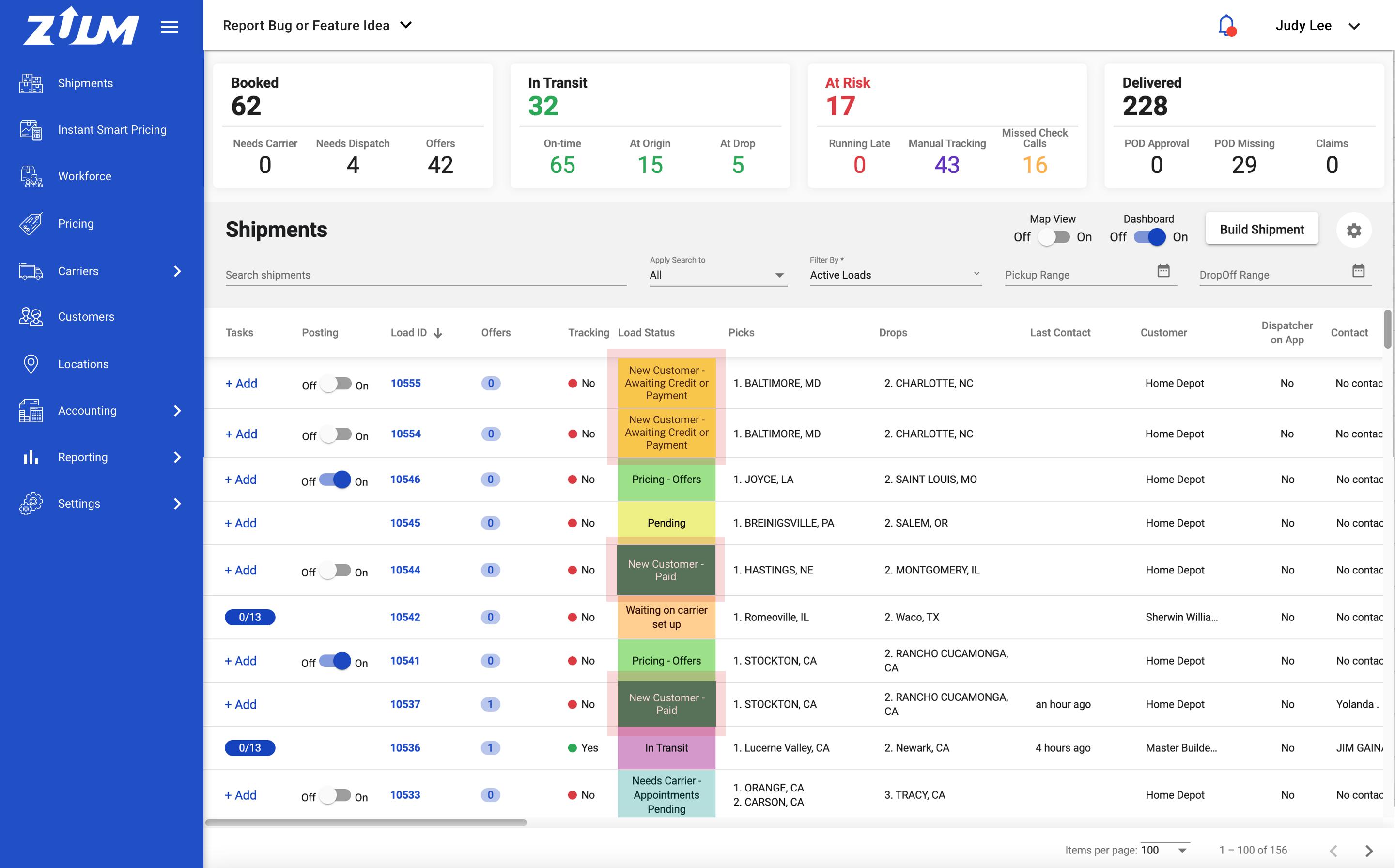

Shipment Board - New Status

1 As a user, I can see loads that the shipper posted with the according status'.

Design: Invision Link

Since shippers can book a load and apply for credit/pay for the load after, we will be creating a new status:

New Customer - Awaiting Credit or Payment

This gives the shipper the chance to book their load but lets the brokerage know that the shipper hasn't paid for the load yet. So the brokerage knows they don't need to cover the load just yet.

Once the shipper paid for the load or has received credit to cover for the load, the status will update to:

New Customer - Paid

This lets the brokerage know that the load has been paid and can start looking for a carrier.

Credit Application Queue - Manual

M1 As a user, I can view and manage credit applications done by shippers.

Design: Invision Link

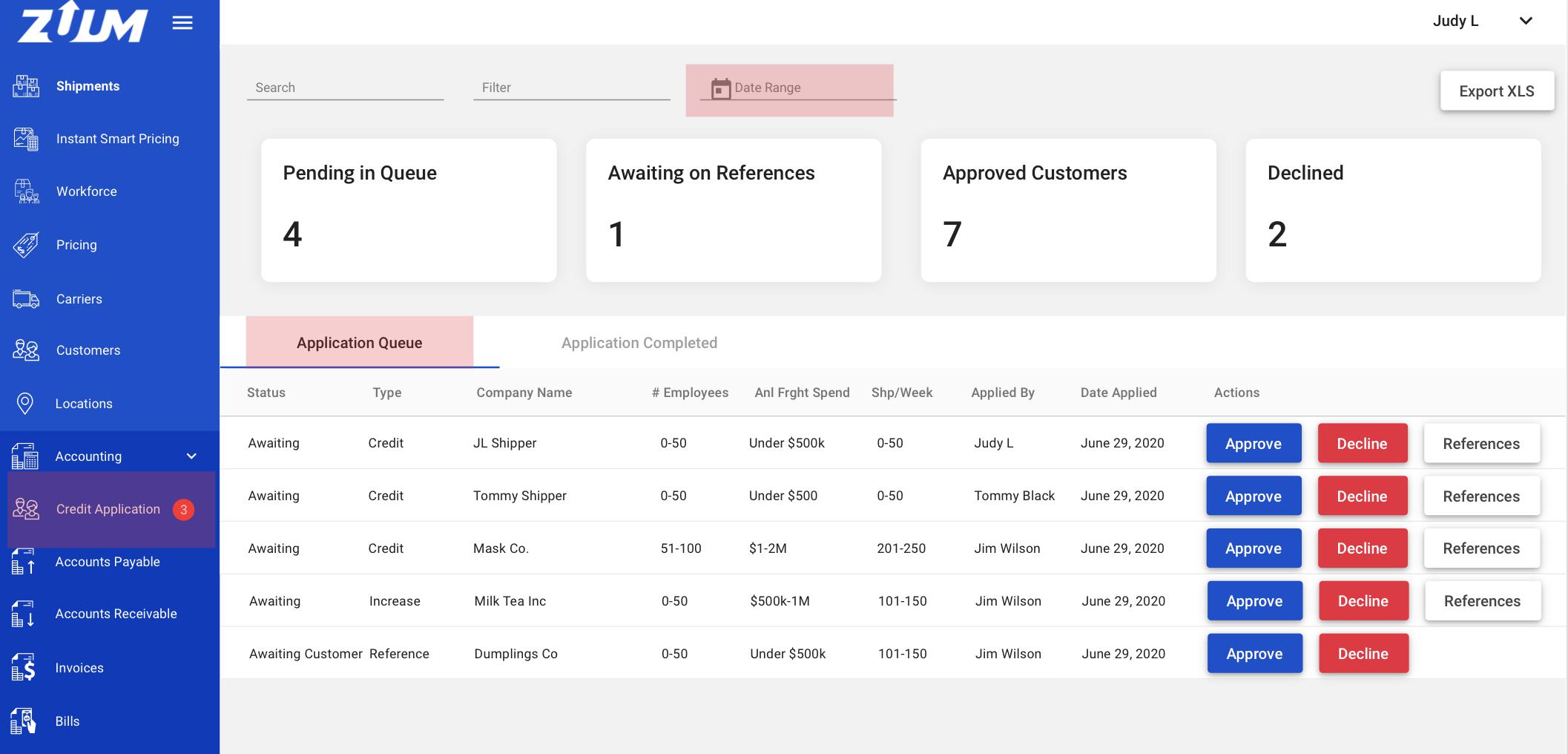

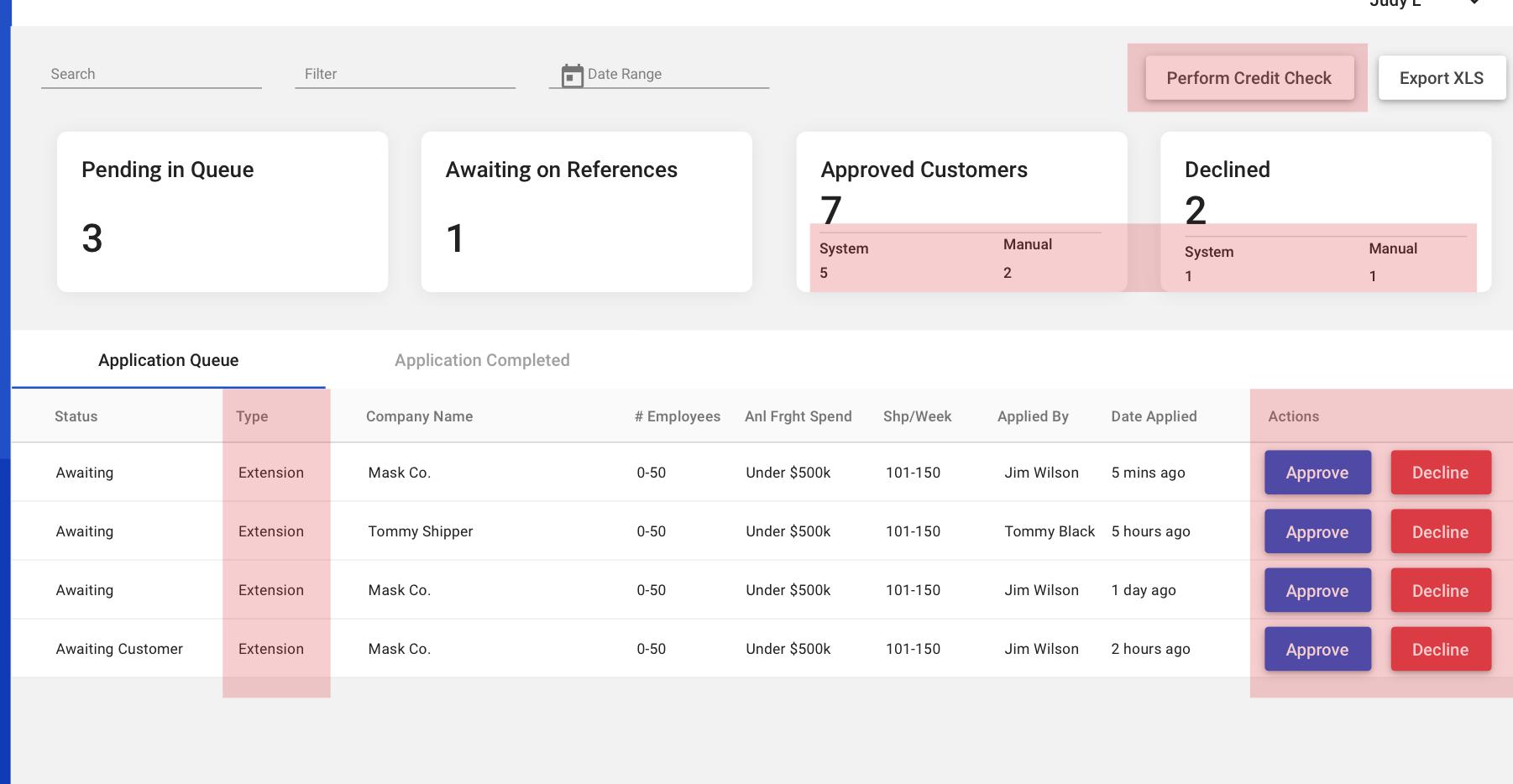

A new page will be added under ‘Accounting’ as 'Credit Application'. This is where the credit applications will be listed when the shipper applies for credit.

we will be using the notification badge on the menu - It’s important for the admin to see these applications since they are waiting to be approved.

Things to be displayed:

Dashboard

Search, Filter, Date Range (by default, it will display the last 30 days)

M2 As a user, I can view a list of credit applications in queue, waiting for my response.

Things to be displayed on the table: Status, Type, Company Name, Number of Employees, Annual Freight Spend, Number of Shipments per Week, Date Applied, Actions - Approve, Decline, References

There are 3 different types: Credit (applying for credit), Increase (Credit limit increase request), and Reference

For reference, the status will change depending if the admin is waiting on the customer and when the user needs to review the references. Once the admin request for references, the

Referencebutton will be removed.

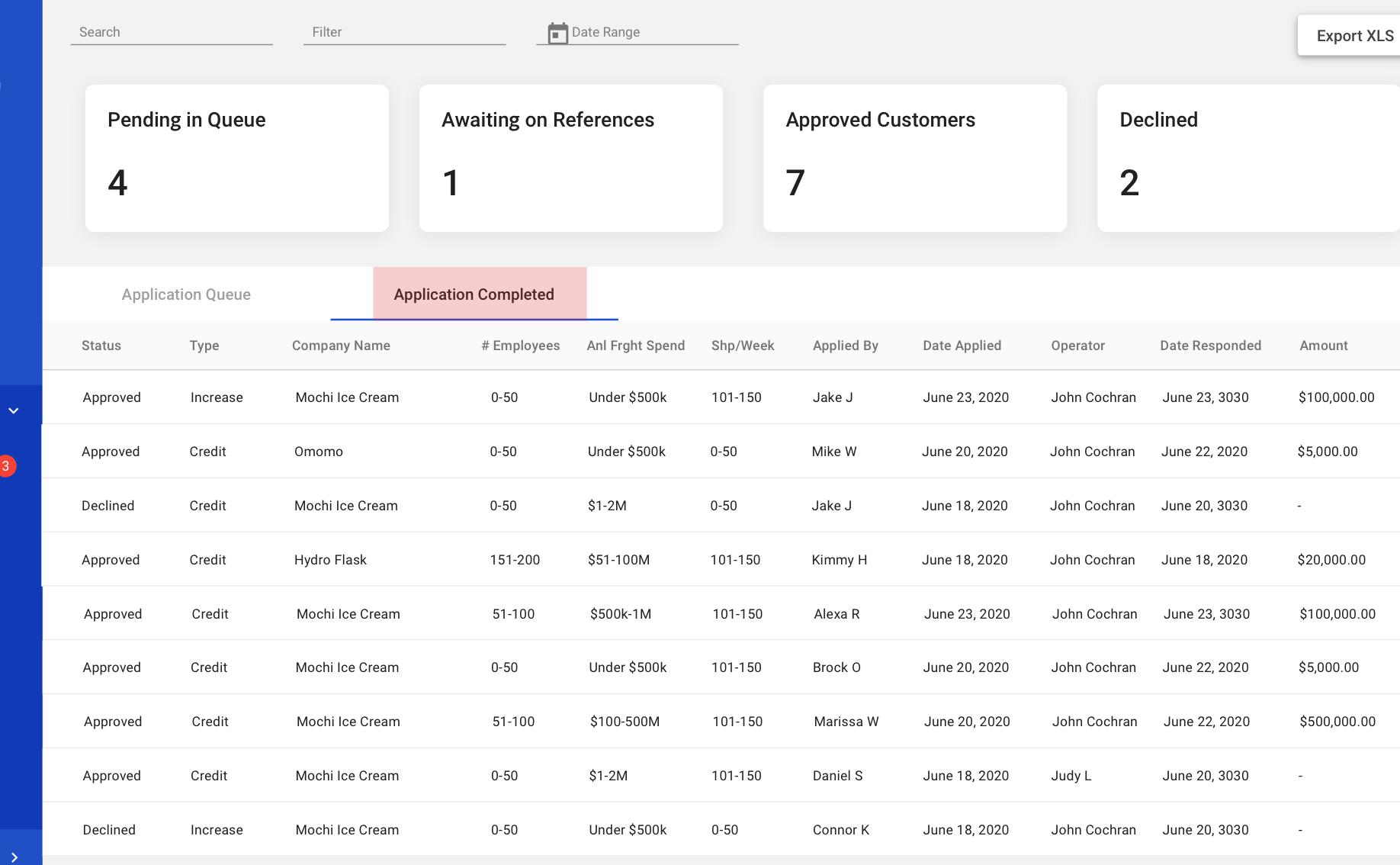

M3 As a user, I can click the Application Completed tab to view a list of applications that received my response.

Design: Invision Link

Things to be displayed on the table: Status, Type, Company Name, Number of Employees, Annual Freight Spend, Number of Shipments per Week, Applied by, Date Applied, Operator, Date Responded, Amount

Operator - this is the admin user who approved or declined the application

Date Responded - the date when the admin approved or declined the application

Amount - the credit value the shipper was given. If none, then it can be blank or use dash

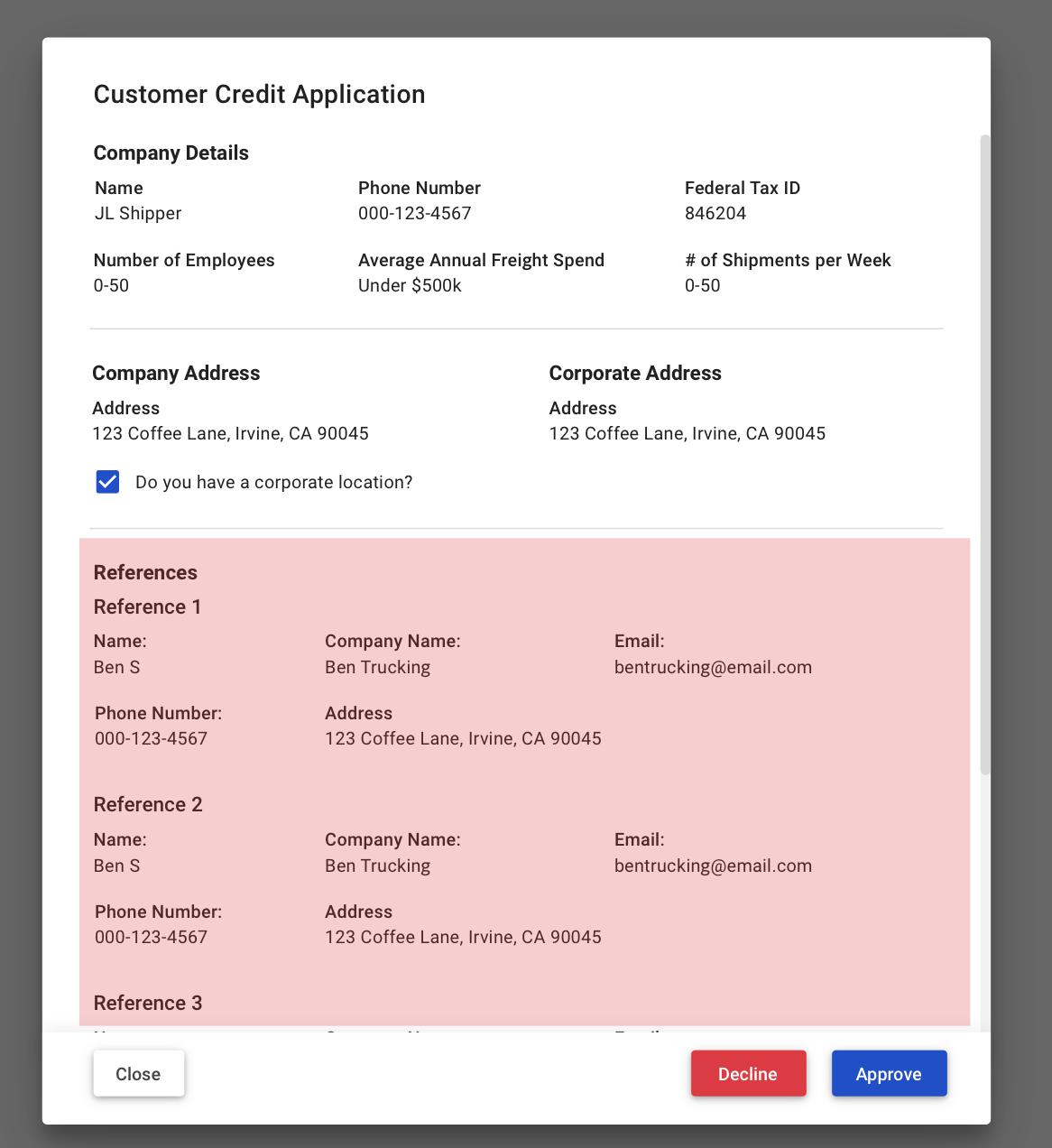

M4 As a user, I can click on a row to view the application form.

When the admin clicks on a row, a modal will appear with the shipper credit application details. Action buttons will be available at the bottom to

ApproveDeclineor requestReferences.

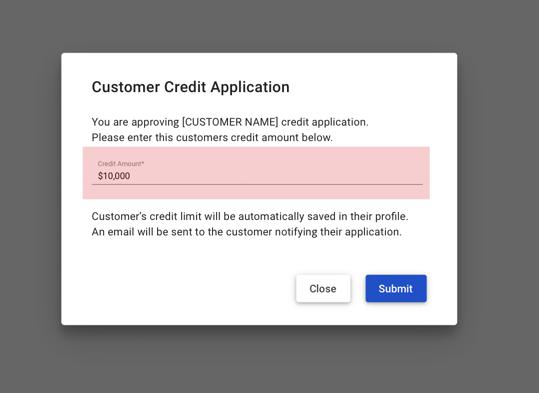

M5 As a user, I can approve an application for Zuum credit.

Design: Invision Link

When the user clicks

Approvethe modal will change where a value needs to be entered.This will be the shipper’s credit limit.

Once submits, this will be added to the shippers profile

Credit Limit

The credit limit should then show up on the shipper’s Invoice page and be available when the shipper books a shipment.

The application will move to the ‘Application Completed' tab with update status.

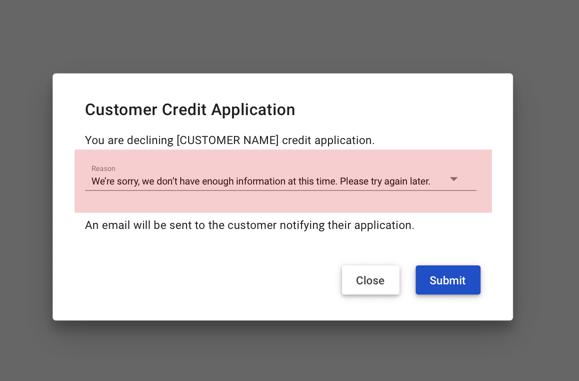

M6 As a user, I can decline an application for Zuum credit.

Design: Invision Link

When the user clicks

Declinethe modal will change where a dropdown text field will appear. There will be two pre-set reasons that the user can select:We’re sorry, we don’t have enough information at this time. Please try again later.

We’re sorry, you currently don’t qualify for a credit increase at this time. Please try again later.

Once submits, the shipper will not have any credit saved to their profile. The Invoices page will have the

Apply for Creditbutton available again.The application will move to the 'Application Completed' tab with updated status.

M7 As a user, I can request for references and view the application with references.

When the user clicks

Referencethey are requesting the customer to provide 3 references.The status will change to ‘Awaiting Customer’ until the shipper provides references

The application will remain in the ‘Application Queue’

Once the customer provides 3 references, the status will update to ‘Awaiting'. The user can click on the cell again to view the application

When viewing the application modal, the

Referencebutton will be removed.

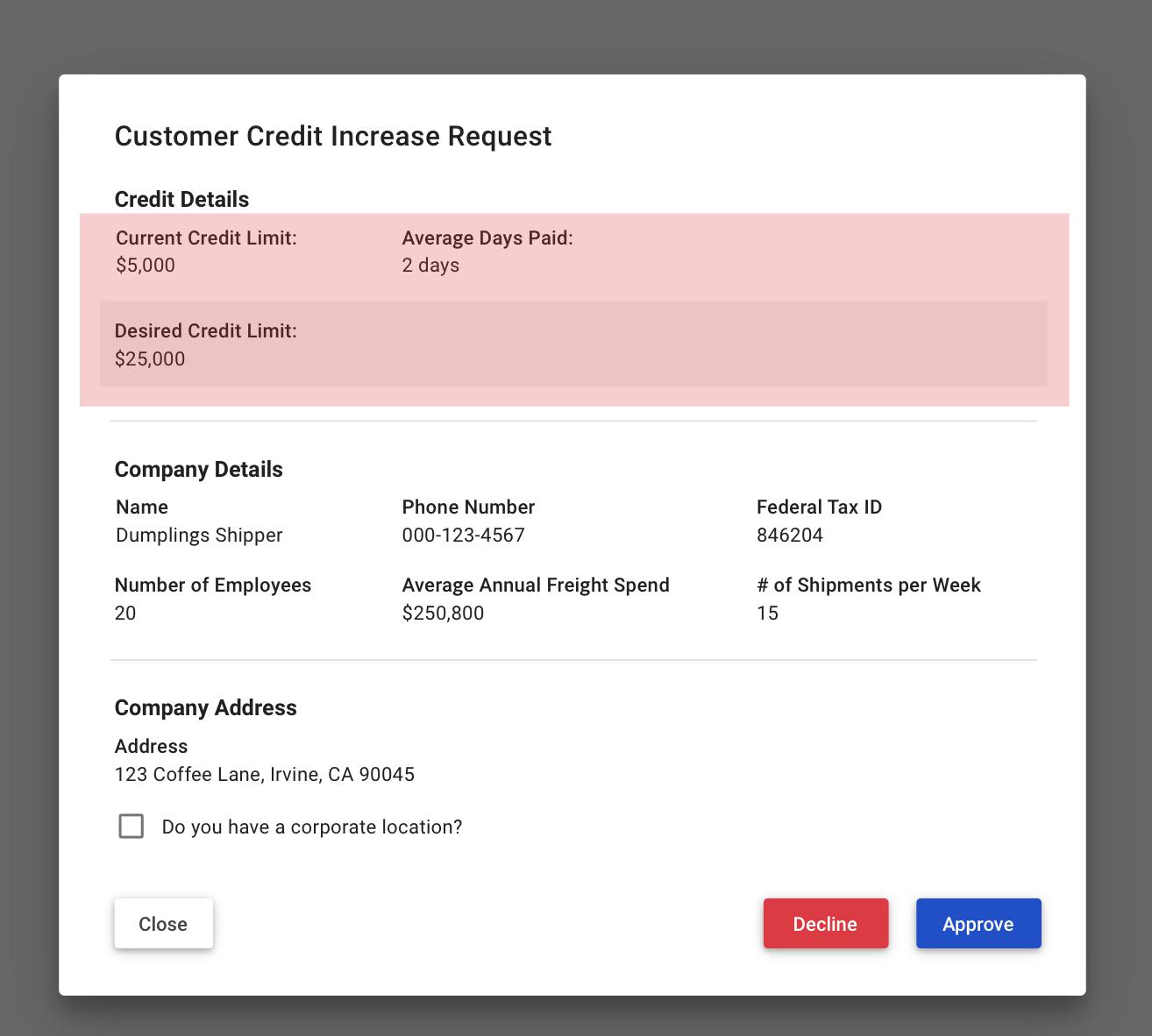

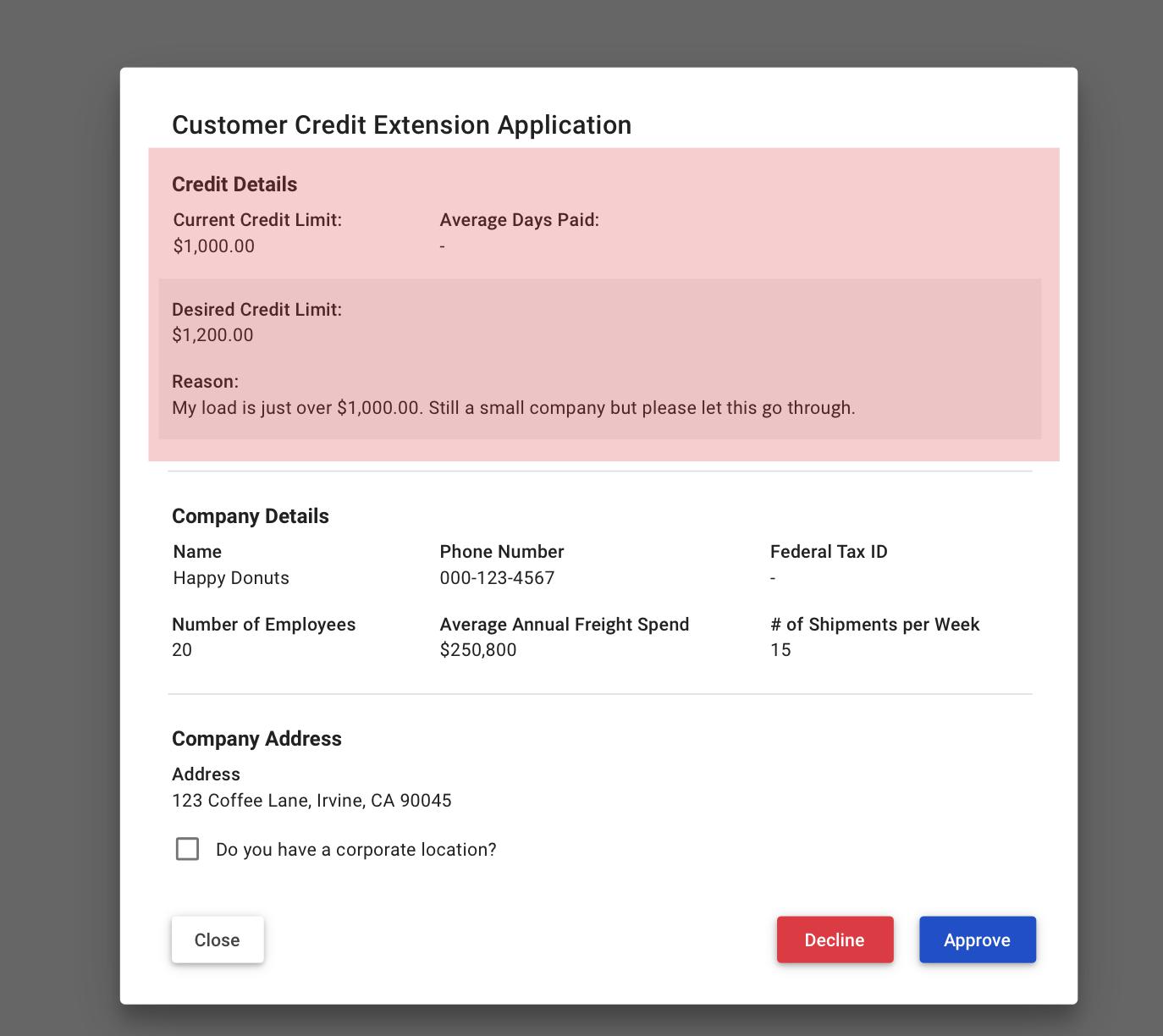

M8 As a user, I can view a credit increase request.

Design: Invision Link

The shipper can request to increase their credit limit. This will show up in the ‘Application Queue’ tab. When the admin clicks on the application, a modal will appear with similar UI when shippers apply for credit.

New fields to be displayed:

Current Credit Limit, Average Days Paid, Desired Credit Limit

The admin can then ‘Approve’ or ‘Decline’ this request.

Once approved, the shipper’s limit should automatically be updated with the ‘Desired Value’.

Credit Application - Automated

A1 As a user, I can view a list of credit applications in queue, waiting for my response.

Design: Invision Link

This page will be slightly different once the credit check process becomes automated:

Perform Credit CheckbuttonDashboard - Approved and Declined

how many applications were approved/declined by the system and manually

Actions - References removed

The only applications in queue will be

ExtensionandReferencessince the credit check will be done automatically.the Reference functionality will be the same as Manual

The Extension is when the customer request for a credit extension

A2 As a user, I can view the Application Completed tab.

Design: Invision Link

It will remain the same, but instead, the ‘Operator’ will also display System if it was done automatically.

A3 As a user, I can view a credit extension application.

Design: Invision Link

When a shipper is booking a load but their load rate is over their available credit, the shipper can request for a credit extension. The UI will be similar to the Manual - View Credit Application Extra field include:

Current Credit Limit

Average Days Paid (if applicable)

Desired value

Reason

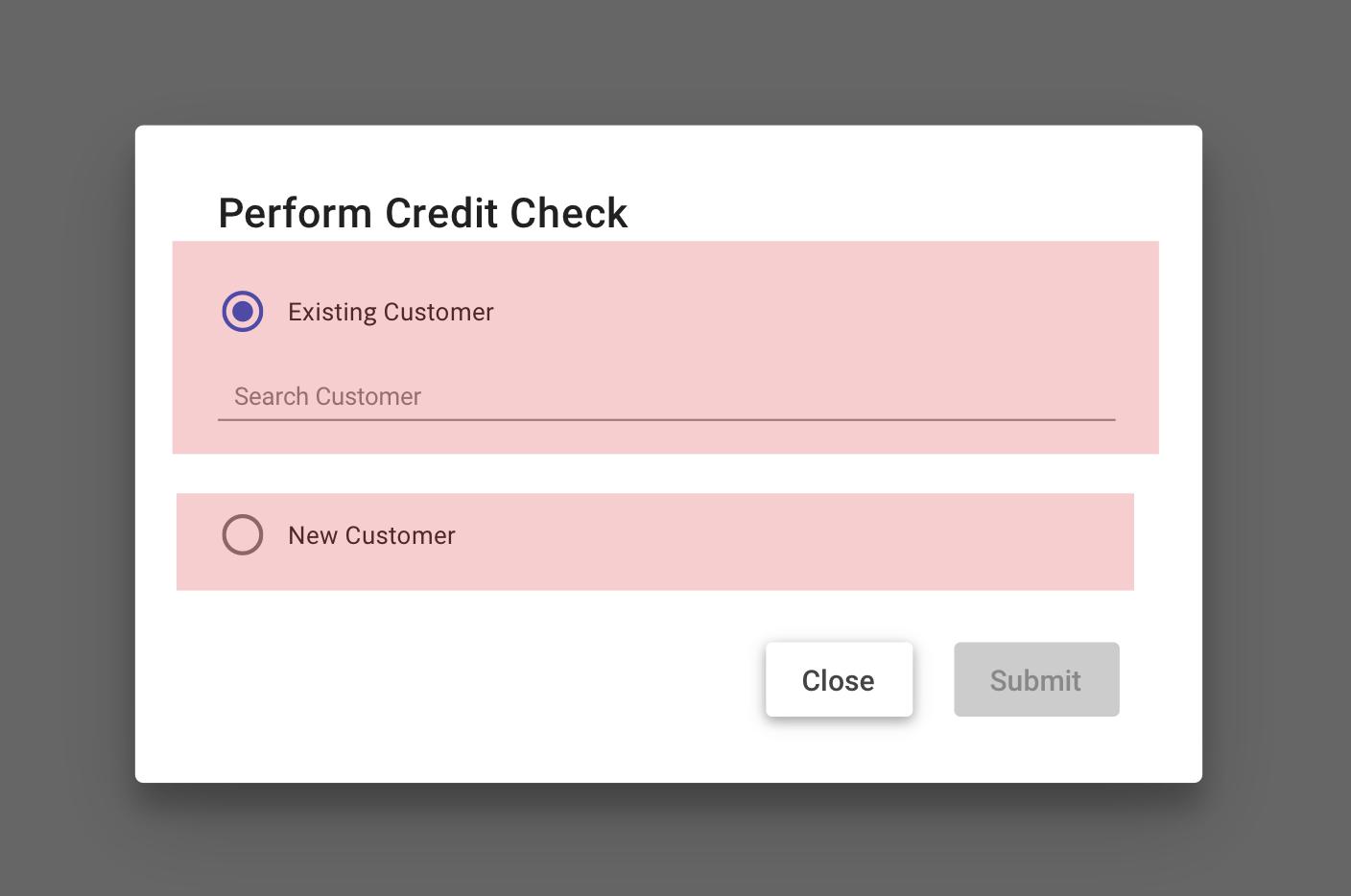

A4 As a user, I can perform an instant credit check.

Design (4 screens): Invision Link

The admin can also perform a credit check (e.g. Salesperson).

Select an existing customer

Run a credit check on a new customer that's not in the system yet.

UI and functionality will be the same as the Shipper Credit Check Flow A ( https://zuumapp.atlassian.net/wiki/spaces/ZUUM/pages/5177356/SH+Credit+Check#Flow-A---Apply-for-Credit-(based-on-a-score-metric---TBD) ).

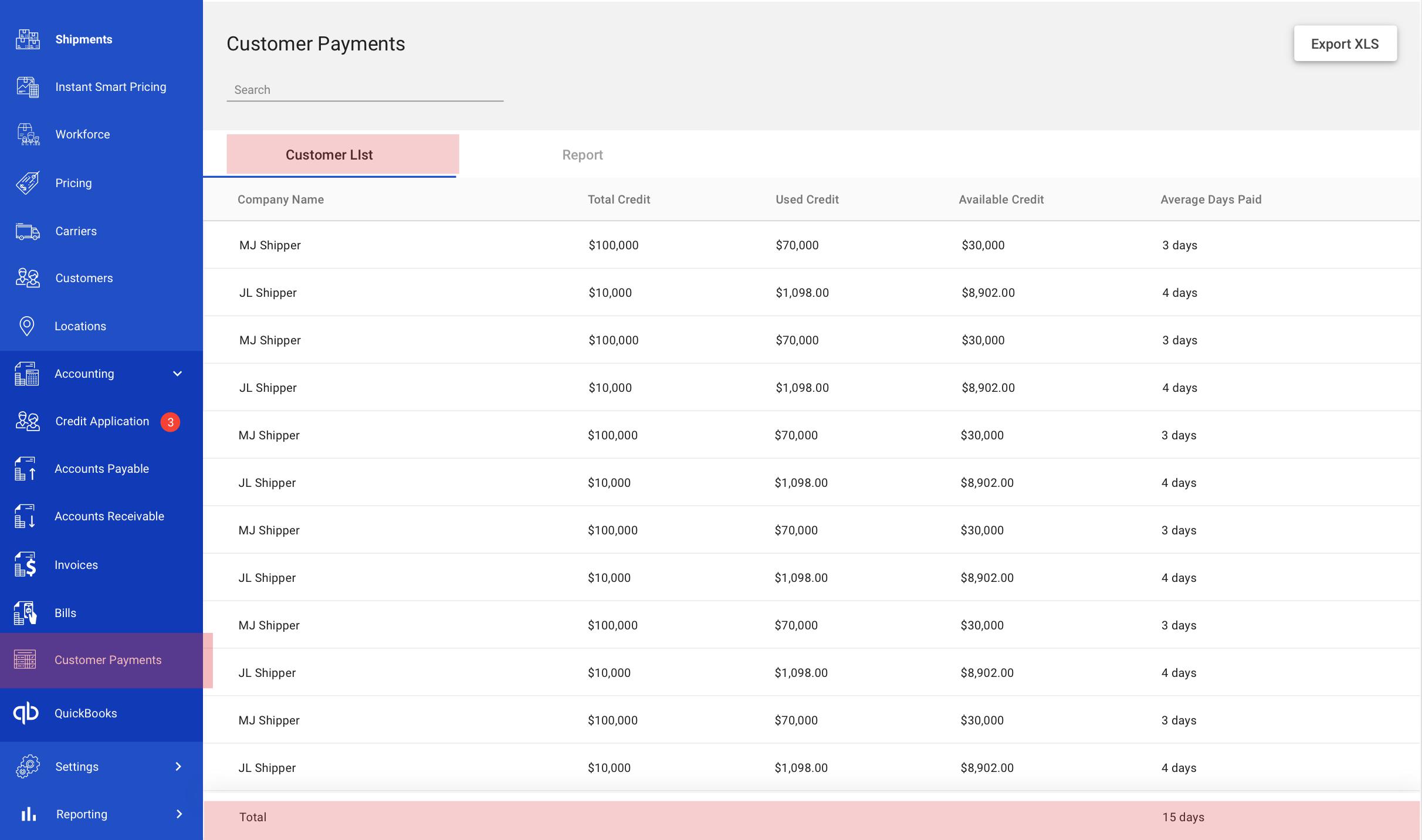

Customer Payments/Credit Score and Reporting

1 As a user, I can view a customer list with their payment history.

Design: Invision LInk

A new page will be added under ‘Accounting’ as 'Customer Payments'. There are two tabs - Customer List - is where admin can keep track of customers with their:

Total credit limit

Available

Used

Days of paid

The days of pay is when the invoice is available (day of delivery) and how many days it takes for the customer to pay. This will be a calculated average.

This is a way to track how well they pay and to determine if they qualify for credit or credit increase.

The table will display all customers, regardless if they have credit or not. If the customer does not have credit, the credit columns will remain blank. Every customer should have an average days paid

There will be a set footer where it calculates the overall average days paid for all customers.

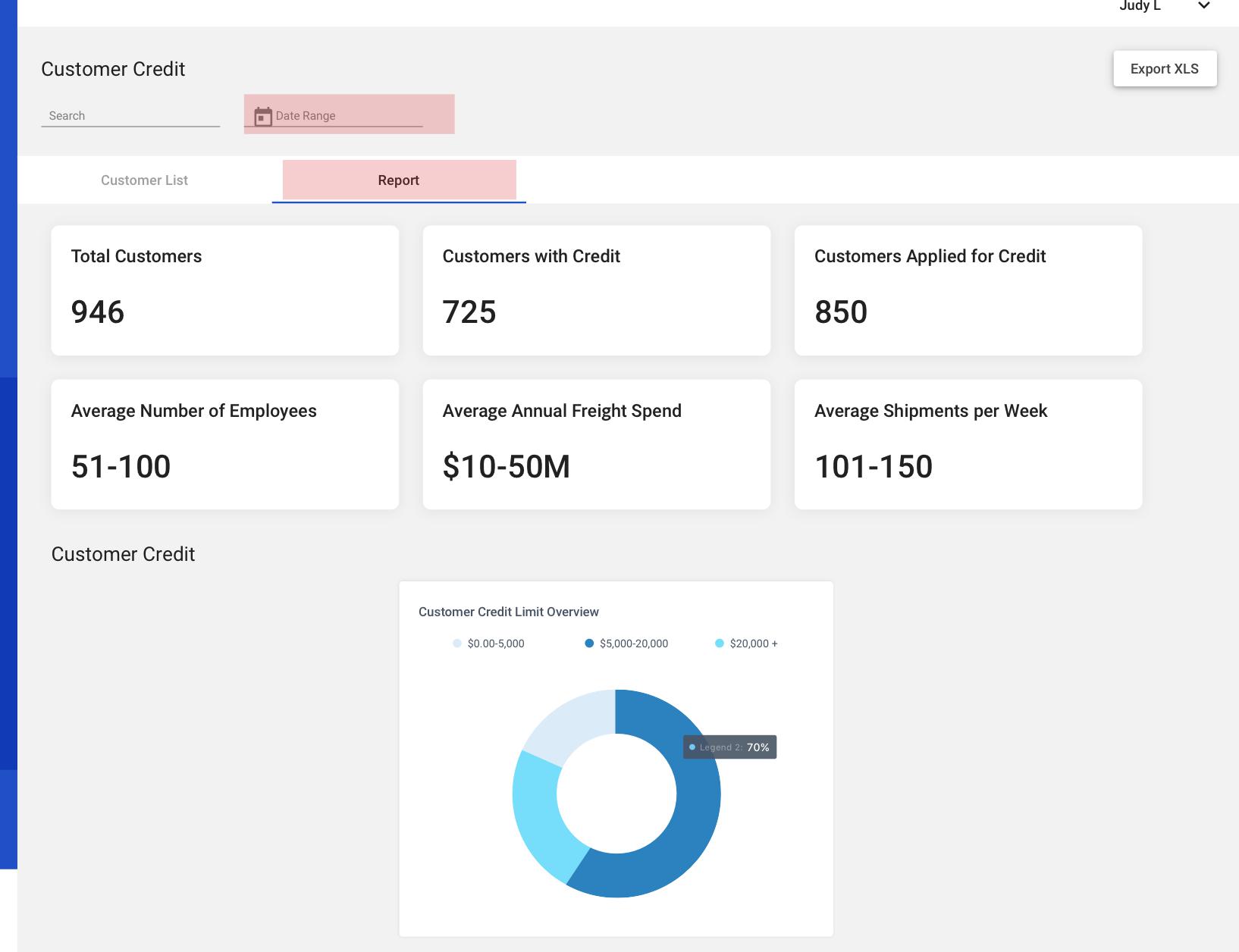

2 As a user, I can view a report of customers and their payments.

Design: Invision Link

This is the second tab - Reporting - there is were the general metrics will lie for customers and keep track of credit. This is only 1.0, it will be refined in 2.0. Things to be displayed:

Total number of customers

Customers with credit

Customers who applied for credit (result doesn't matter here)

Average number of employees - during onboarding

Average annual Freight Spend - during onboarding

Average Shipments per week - during onboarding

Customer Credit Limit Overview - pie graph - TBD

this displays customers with the value assigned of Zuum credit

this is an overview to see which credit range is more common/used